Feeling stressed about money? You’re not alone. Whether you’re juggling bills, struggling to save, or wondering how to invest, personal finance can feel overwhelming. But it doesn’t have to be. By focusing on just a few core principles, you can take control of your financial future.

This article outlines the ten most crucial aspects of personal finance, breaking down complex concepts into simple, actionable steps. From creating a budget to understanding your credit score, you’ll learn everything you need to build a solid financial foundation.

Understanding Your Income and Expenses

The first step toward financial freedom is mastering your income and expenses. You can’t manage what you don’t measure.

Why Tracking Matters

Think of your income as the oxygen for your finances. Expenses? Those are the leaks in your tank. If the leaks are too big, you’ll run out of air.

Tracking your money helps you understand how much is coming in and where it’s all going. This insight is key to identifying wasteful spending and realigning your priorities.

Types of Expenses

Expenses can be categorized into three groups:

- Fixed expenses: Rent, mortgage, or car payments.

- Variable expenses: Groceries, utilities, and gas.

- Discretionary expenses: Dining out, entertainment, or impulse purchases.

Tools for Budgeting and Tracking

Several tools can simplify this process:

- Apps like Mint or YNAB (You Need a Budget).

- Spreadsheets for detailed tracking.

- Old-fashioned pen and paper for simplicity.

Creating a Budget That Works for You

Budgeting often gets a bad reputation, but think of it as a spending plan. A good budget empowers you to spend on what really matters.

Choosing a Budgeting Method

Not all budgets are one-size-fits-all. Here are three popular approaches:

- 50/30/20 Rule: 50% for needs, 30% for wants, and 20% for savings.

- Zero-based budgeting: Assign every dollar a job.

- Envelope system: Use cash envelopes to manage discretionary spending.

Set Realistic Financial Goals

A budget only works if it reflects your life. Are you saving for a home? Paying off debt? Be realistic about what’s achievable based on your circumstances.

Adjust as Life Changes

Life throws curveballs. Stay flexible and adapt your budget when needed.

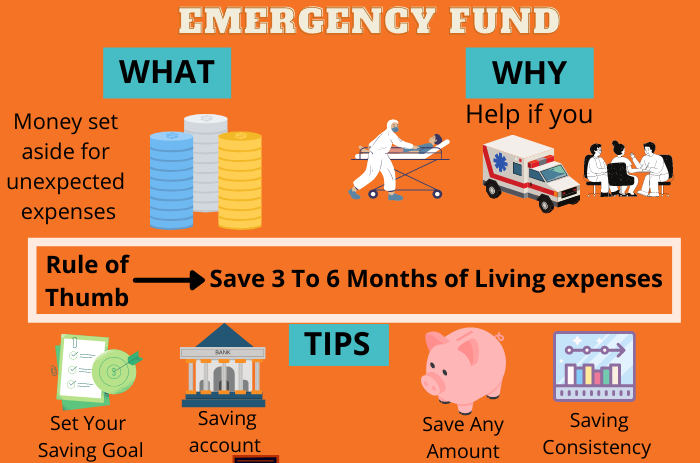

Building an Emergency Fund

If 2020 taught us anything, it’s the importance of an emergency fund.

Why It’s Crucial

An emergency fund protects you from life’s surprises, like unexpected car repairs or medical bills, without going into debt.

How Much to Save

Financial experts recommend saving enough to cover 3–6 months of living expenses.

Where to Keep It

Store your emergency fund in a high-yield savings account. It’s easily accessible but still earns interest.

Managing Debt Wisely

Not all debt is created equal. Some debts, like student loans, might be worth the investment, while others can be a financial trap.

Understanding Good vs. Bad Debt

- Good debt: Mortgages or student loans that offer long-term benefits.

- Bad debt: High-interest credit card debt or payday loans.

Debt Repayment Strategies

Two popular methods include:

- Debt snowball: Pay off the smallest debts first for quick wins.

- Debt avalanche: Focus on high-interest debts to save money over time.

Avoiding High-Interest Debt

Pay your credit card balance in full every month. If you can’t, consider consolidating debt with a lower-interest loan.

Saving for Retirement

Retirement may feel far away, but starting early gives your money more time to grow.

Start Early

Thanks to compound interest, even small contributions now can lead to significant savings over time.

Know Your Retirement Accounts

Popular options include:

- 401(k) (especially if your employer offers matching contributions).

- IRA (Traditional or Roth, depending on your tax situation).

How Much Should You Save?

Many experts recommend saving 15% of your income, starting as early as possible.

Investing for the Future

Investing isn’t just for the wealthy. It’s essential for growing your wealth over time.

Basic Principles

- Start early to harness compound growth.

- Diversify to spread your risk.

- Invest with a long-term perspective.

Investment Options

- Stocks for higher growth potential.

- Bonds for stability.

- Mutual funds for diversification.

Managing Risk

Understand your risk tolerance and rebalance your portfolio regularly.

Protecting Your Assets with Insurance

Insurance provides peace of mind, protecting you and your loved ones from financial hardship.

Types of Insurance to Consider

- Health Insurance for medical emergencies.

- Life Insurance to protect your family.

- Auto and Home Insurance for accidents and property damage.

How Much Coverage to Get

Assess your personal risks and assets to determine adequate coverage.

Shopping for Insurance

Compare quotes from different providers to ensure you get the best value for your money.

Understanding Credit and Credit Scores

Your credit score is a key metric in your financial life, affecting everything from loan approvals to interest rates.

How Credit Scores Work

Credit scores range from 300 to 850 and measure factors like payment history and credit utilization.

Boost Your Score

- Pay bills on time.

- Keep credit utilization below 30%.

- Avoid opening unnecessary accounts.

Check Your Score

Monitor your credit through free annual credit reports to spot errors.

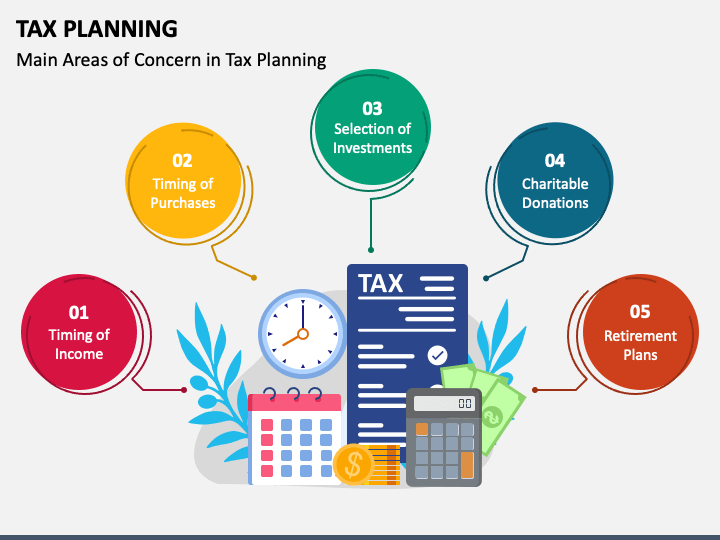

Planning for Taxes

Taxes are inevitable, but smart planning can save you money.

Types of Taxes

Understand what you owe, from income taxes to property taxes.

Reducing Tax Liability

- Max out retirement account contributions.

- Claim all eligible deductions.

- Keep tax records organized.

When to Seek Professional Advice

A CPA can help maximize deductions and identify tax-saving strategies.

People Also Ask

What is the best way to start budgeting for beginners?

Start simple with the 50/30/20 Rule. Use an app like Mint to track your spending and categorize expenses.

How can I rebuild my credit score?

Pay all bills on time, reduce your debt-to-income ratio, and monitor your credit report for errors.

Why is an emergency fund important?

An emergency fund prevents financial ruin during unexpected events, like job loss or medical emergencies.

Taking Control of Your Financial Future

Personal finance doesn’t have to be intimidating. By focusing on these ten areas, you can take steady steps toward a more secure and fulfilling financial future.

The key to success? Start now, even if you can only tackle one area at a time. Your future self will thank you.

Are you ready to take the first step? Start by creating a simple budget today and watch how empowered you feel once you gain control over your money.