Managing your money might not feel like the most exciting task on your to-do list, but it’s one of the most essential. Whether you’re saving up for that dream vacation, paying down student loans, or planning for early retirement, personal finance is the roadmap to achieving your financial goals.

But what exactly is personal finance? Why is it so important, and how can mastering it set you on a path to financial freedom? By the end of this guide, you’ll have a clear grasp of the fundamentals of personal finance, practical tips to get started, and the motivation to make your money work harder for you.

What Is Personal Finance?

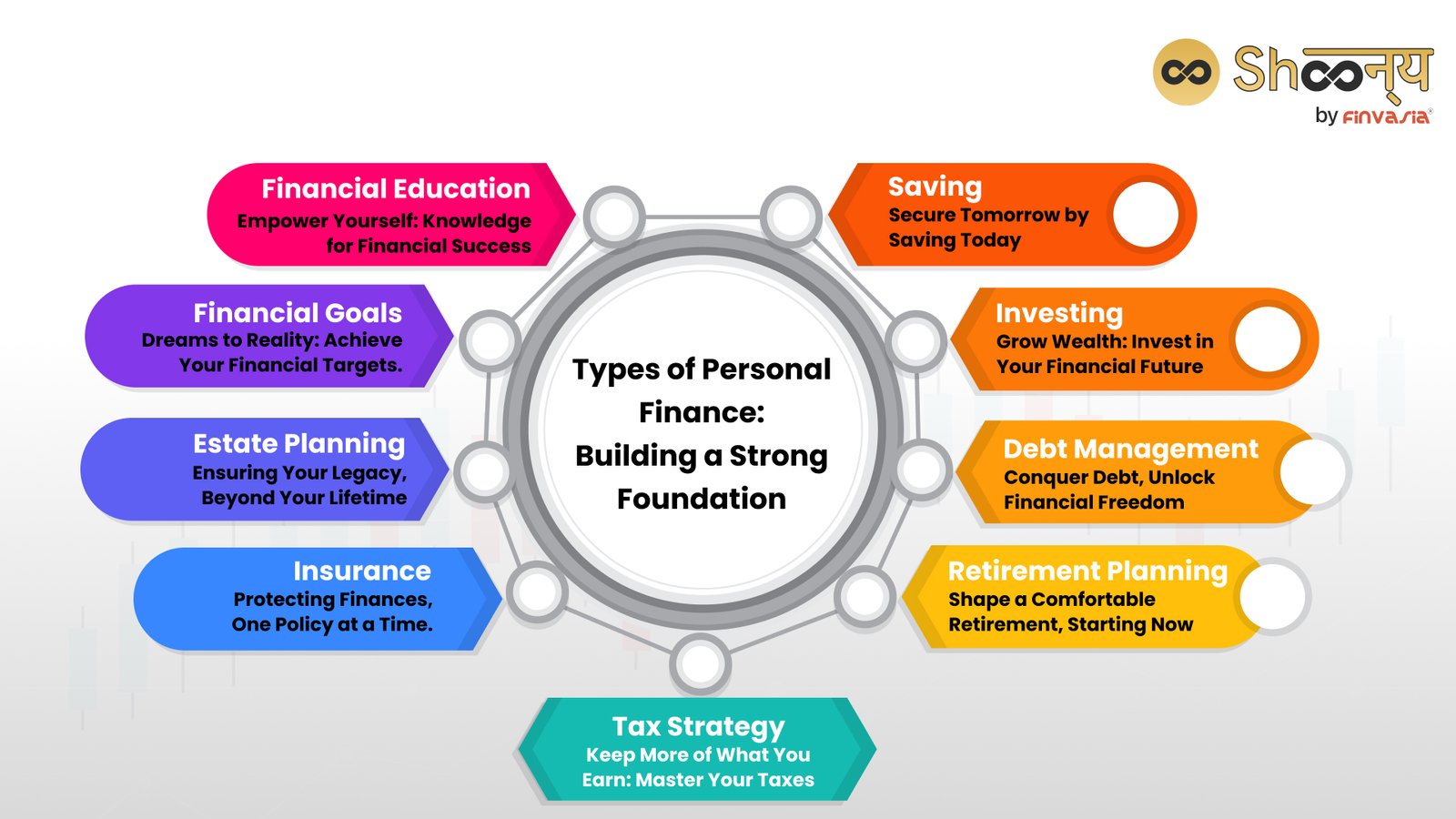

Simply put, personal finance is the art of managing your money to achieve your life’s goals. It encompasses everything from budgeting your paycheck to investing for the long term and planning for emergencies. Unlike corporate finance, which focuses on businesses, personal finance puts you in the driver’s seat of your financial decision-making.

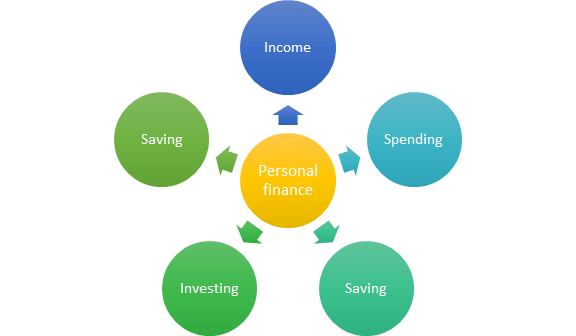

Components of Personal Finance

- Budgeting

Budgeting is the foundation of personal finance. It’s about tracking your income and expenses to ensure you’re living within your means while saving for important goals. From the simple 50/30/20 rule (essential costs, discretionary spending, and savings) to zero-based budgeting, finding the right approach can make all the difference.

- Saving

Savings provide a cushion for your financial life. Whether it’s building an emergency fund or setting aside money for retirement, saving is essential for long-term stability. Popular strategies include automating savings transfers or using high-yield savings accounts.

- Investing

Investing enables you to grow your wealth over time. By putting your money to work in stocks, bonds, real estate, or mutual funds, you’re creating opportunities for compound returns. It’s crucial to assess your risk tolerance and prioritize diversification to protect your investments.

- Debt Management

Debt can either be a tool or a trap, depending on how you manage it. Healthy financial strategies focus on reducing high-interest debt first (like credit cards) and using systems like the debt snowball or avalanche method for repayments.

Goals of Personal Finance

At its core, personal finance is about achieving:

- Financial Security: Having enough money to cover your needs without undue stress.

- Independence: The ability to make financial decisions without relying heavily on loans or external help.

- Wealth Accumulation: Building assets over time to create a financially stable future.

Why Is Personal Finance Important?

Without a plan for your finances, it’s easy to end up feeling lost or overwhelmed. Here are some key reasons why personal finance is critical:

Financial Security and Peace of Mind

Managing your money gives you stability. Imagine not stressing over rent payments or being able to handle a medical emergency without going into debt. This peace of mind allows you to focus on enjoying life, not worrying about bills.

Achieving Financial Goals

Want to buy your first home, start a business, or travel the world? These dreams require strategic financial planning. Personal finance helps you allocate your resources to align with both short-term and long-term goals.

Handling Unexpected Expenses

Life is unpredictable, and surprises can come with hefty price tags. A well-managed emergency fund can save you from financial crises, such as car repairs or unexpected medical bills.

Building Wealth for the Future

By prioritizing saving and investing, personal finance paves the path toward future prosperity. Starting early—even with modest contributions—is the key to leveraging the power of compounding.

Core Components of Personal Finance

Budgeting 101

Budgeting is about tracking where your money goes and planning how to best allocate it.

Popular Budgeting Methods:

- 50/30/20 Rule: Allocate 50% to essentials, 30% to discretionary spending, 20% to savings/debt.

- Zero-Based Budgeting: Account for every dollar of income by assigning it to a specific expense or saving category.

Budgeting tools like Mint or YNAB (You Need A Budget) can simplify the process.

Saving Made Simple

Set clear savings goals, whether it’s for a vacation, an emergency cushion, or a down payment on a house. Utilize savings apps like Acorns or open a high-yield savings account for better returns.

Tip: Automate your savings to ensure consistency. Many banks and payroll systems allow you to allocate a portion of your paycheck directly to savings.

Investment Essentials

Investing is key for growing wealth. But how do you start?

Common Investment Options:

- Stocks: Partial ownership in a company, ideal for growth if you can handle market fluctuations.

- Bonds: Loans you give to organizations in exchange for steady, low-risk returns.

- Mutual Funds or ETFs: Diversified collections of stocks and/or bonds.

The golden rule of investing is diversification. Tools like ETRADE, Vanguard, or Robinhood make it easier to get started.

Mastering Debt Management

Debt doesn’t have to be the enemy. Focus on eliminating high-interest debt first while maintaining minimum payments on other obligations.

Popular Repayment Strategies:

- Debt Snowball: Pay off the smallest debt first to build momentum.

- Debt Avalanche: Target high-interest debt first for maximum savings.

Practical Tips for Personal Finance Success

- Track Your Spending: Small expenses add up quickly! Use apps like PocketGuard to monitor spending.

- Automate Savings and Investments: Remove the temptation of spending; automate regular contributions to savings and investment accounts.

- Set Clear Goals: Whether it’s paying off debt or hitting $10k in savings, write down measurable, time-bound goals.

- Review and Adjust Regularly: Stay flexible. Financial plans should evolve with your circumstances.

Common Personal Finance Mistakes to Avoid

- Not having a budget.

- Ignoring high-interest debt while focusing on smaller, less urgent loans.

- Postponing retirement savings.

- Making impulsive or emotional investment choices.

- Neglecting insurance coverage, risking unexpected costs.

Tools and Resources to Help You

- Budgeting Apps: Mint, YNAB, PocketGuard.

- Investment Platforms: Vanguard, Fidelity, Robinhood.

- Educational Hubs: Investopedia, NerdWallet.

- Professional Advisors: For tailored advice, work with a certified financial planner.

Real-Life Examples

Jane, a 28-year-old designer, started tracking her spending after realizing she was constantly in debt. Implementing the 50/30/20 rule allowed her to save $1,000 in just six months. Now, she’s working toward her dream of starting her own business.

Tom and Sarah, newlyweds, created a joint budget for their household. By prioritizing savings and using the debt snowball method, they paid off $20,000 in student loans in two years.

People Also Ask (PAA)

What is personal finance, and why does it matter?

Personal finance is the management of money, including budgeting, saving, and investing. It ensures financial stability and goal achievement.

How do I create a personal finance plan?

Start by setting clear financial goals, creating a budget, saving consistently, and investing wisely.

What are the five areas of personal finance?

The key areas are budgeting, saving, investing, debt management, and retirement planning.

Start Managing Your Money Today

You’ve got the tools, you’ve got the knowledge, and now it’s time to get started. Personal finance isn’t about perfection; it’s about progress. Begin tracking your expenses, set actionable goals, and don’t shy away from seeking professional advice if you need it.

Remember, every dollar you manage well today is a step closer to financial freedom tomorrow.